Renters Insurance in and around Columbus

Renters of Columbus, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Think about all the stuff you own, from your bookshelf to entertainment center to children's toys to golf clubs. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of Columbus, State Farm can cover you

Renting a home? Insure what you own.

Why Renters In Columbus Choose State Farm

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent David Grant can help you identify the right coverage for when the unpredictable, like a fire or a water leak, affects your personal belongings.

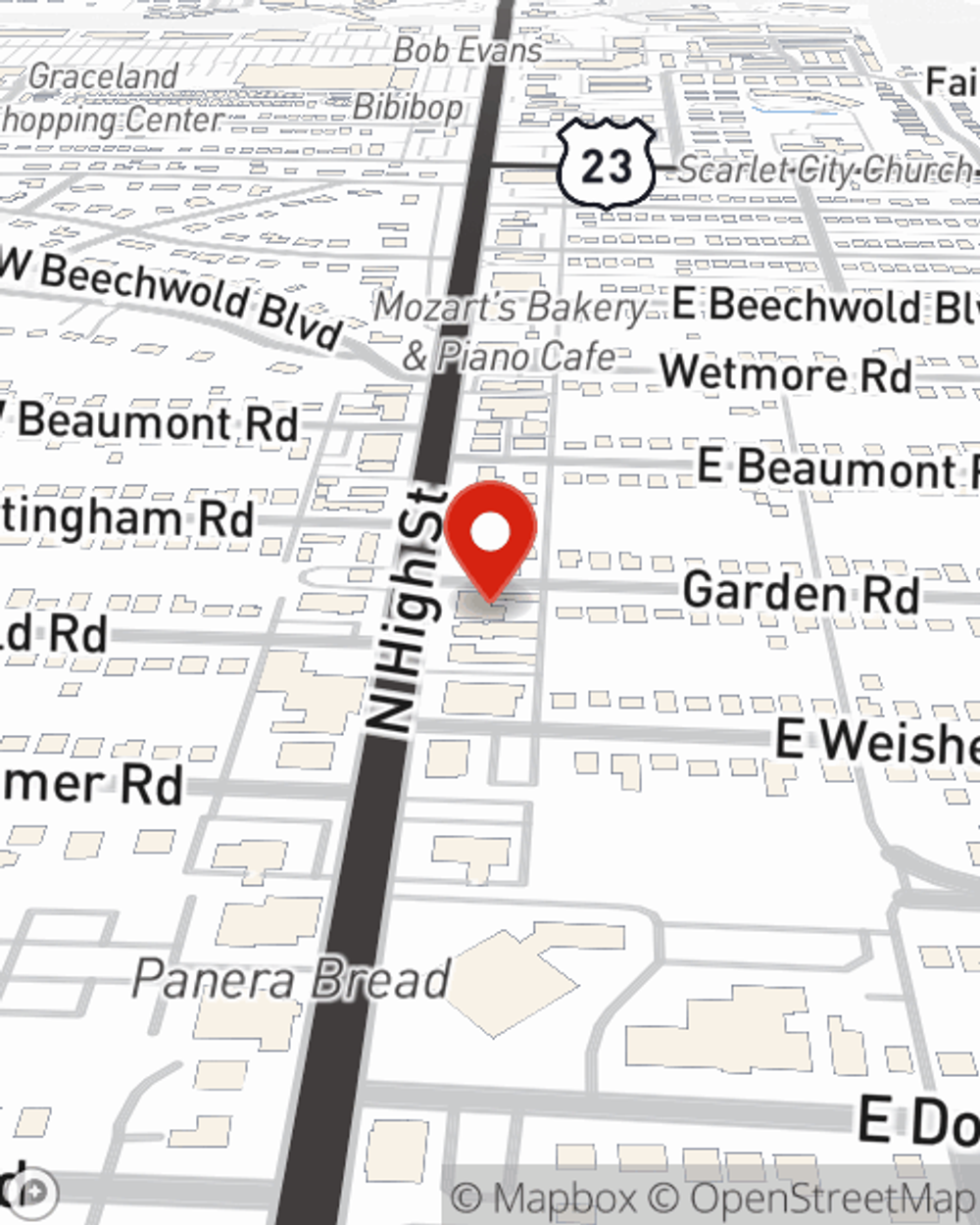

More renters choose State Farm® for their renters insurance over any other insurer. Columbus renters, are you ready to learn how you can protect your belongings with renters insurance? Get in touch with State Farm Agent David Grant today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call David at (614) 262-1055 or visit our FAQ page.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

David Grant

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.