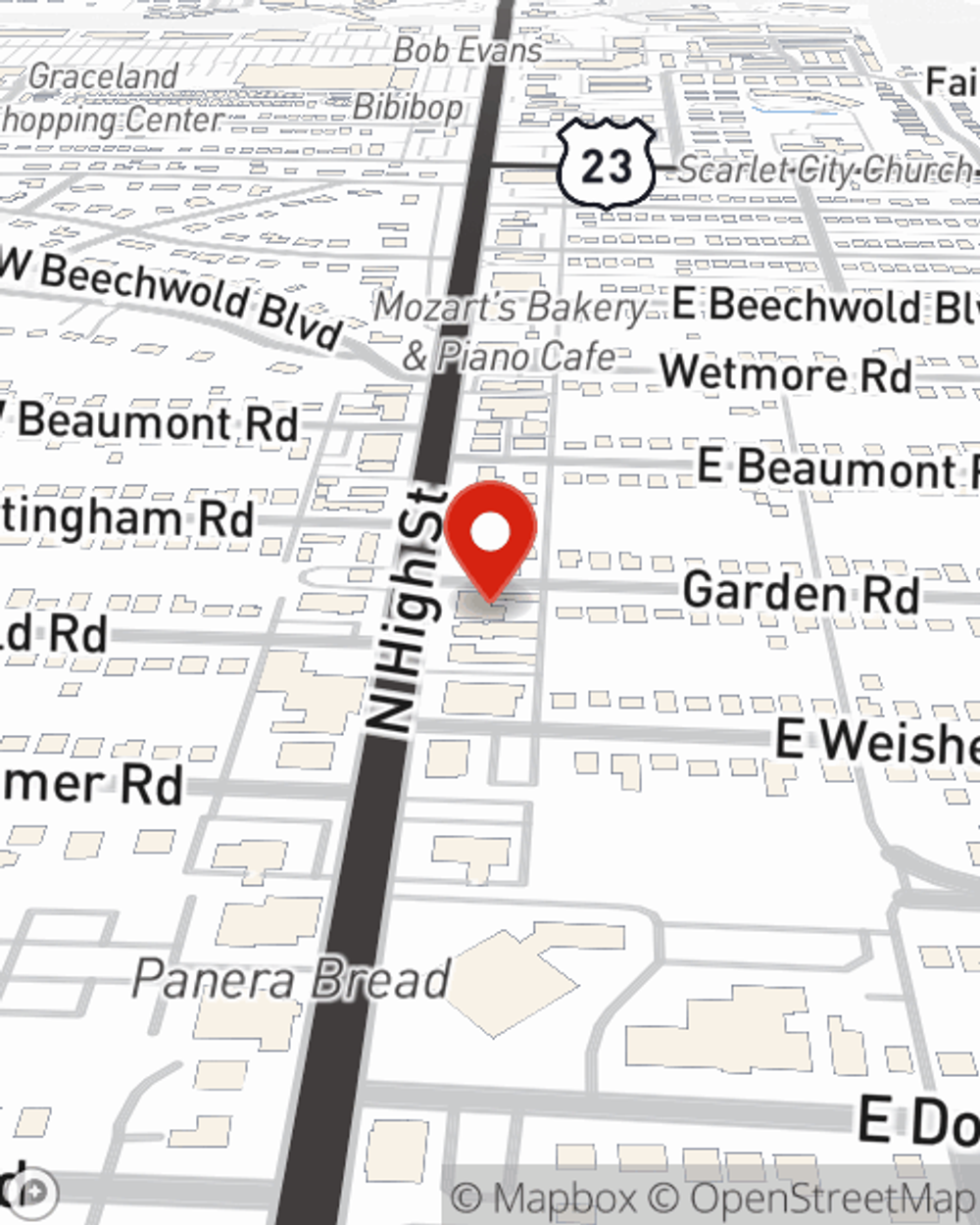

Business Insurance in and around Columbus

Calling all small business owners of Columbus!

No funny business here

Coverage With State Farm Can Help Your Small Business.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent David Grant understands the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to explore.

Calling all small business owners of Columbus!

No funny business here

Insurance Designed For Small Business

Whether you are a photographer a surveyor, or you own a toy store, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent David Grant can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and business property.

It's time to reach out to State Farm agent David Grant. You'll quickly perceive why State Farm is one of the leading providers of small business insurance.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

David Grant

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.